wisconsin auto sales tax rate

Form BTR-101 - Application for Business Tax Registration. Groceries and prescription drugs are exempt from the Wisconsin sales tax.

Wisconsin State 2022 Taxes Forbes Advisor

With local taxes the total sales tax.

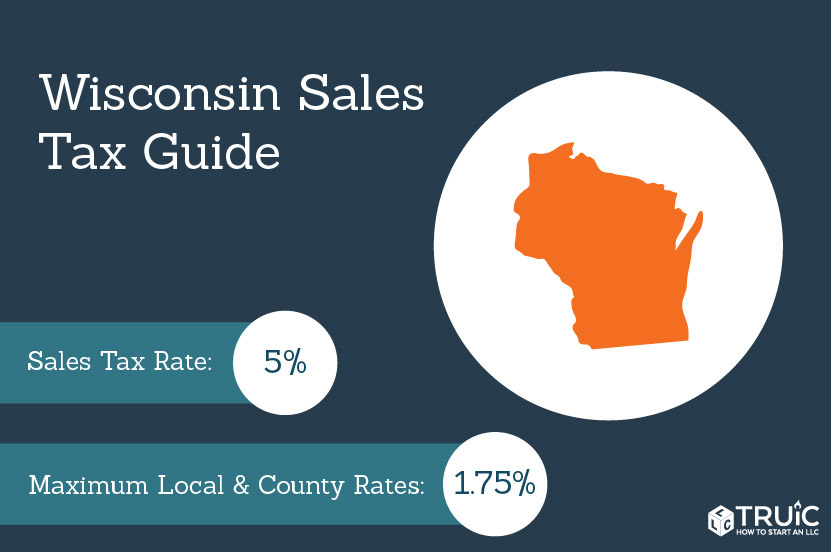

. Wisconsin has a 5 statewide sales tax rate but also has 265 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 046 on top of the state tax. 5 county. If you have questions about how to proceed you can call the department at 608 266-1425.

United States vehicle sales tax varies by state and often by counties cities municipalities and localities within each state. Any taxes paid are submitted to DOR. Wisconsin collects a 5 state sales tax rate on the purchase of all vehicles.

Counties and cities can charge an additional local sales tax of up to 06 for a maximum possible combined sales tax of 56. The Wisconsin Department of Revenue DOR reviews all tax exemptions. Sales tax for a leased vehicle is calculated based on the states tax percentage and the cost of the lease payments.

Important Changes Menominee County tax begins April 1 2020 Baseball stadium district tax ends March 31 2020 Outagamie County tax begins January 1 2020. Car tax as listed. Call DOR at 608 266-2776 with any sales tax exemption questions.

Download all Wisconsin sales tax rates by zip code. You may be penalized for fraudulent entries. 31 rows The state sales tax rate in Wisconsin is 5000.

The sales tax charged on car purchases in Wisconsin is 5 so you can expect to pay at least 5 of the total vehicle price for the tax fee. The Milwaukee County Wisconsin sales tax is 560 consisting of 500 Wisconsin state sales tax and 060 Milwaukee County local sales taxesThe local sales tax consists of a 050 county sales tax and a 010 special district sales tax used to fund transportation districts local attractions etc. Wisconsin Department of Revenue.

Motor Vehicle Sales Leases and Repairs. In addition there may be county taxes of up to 05 along with a stadium tax of up to 01. Wisconsin law says you can sell up to five vehicles titled in your name in 12 months.

Wisconsin collects a 5 state sales tax rate on the purchase of all vehicles. Form S-211 - Sales and Use Tax Exemption Certificate. The Wisconsin sales tax is a 5 tax imposed on the sales price of retailers who sell license lease or rent tangible personal property certain coins and stamps certain leased property affixed to realty or certain digital goods or sell license perform or furnish taxable services in Wisconsin.

WisDOT collects the wheel tax at the time of first registration and at each registration renewal. Some dealerships also have the option to charge a dealer service fee of 99 dollars. You may have to hire an attorney if the department cannot resolve the issue to your satisfaction.

In the table below we show the car sales tax rate for each state. However if a vehicle purchased in another state the District of Columbia or the Commonwealth of Puerto Rico is subject to sales tax in that jurisdiction a credit against Wisconsin sales or use tax due is allowed for sales tax paid to that jurisdiction up to the amount of Wisconsin tax due sec. Publication 202 517 Printed on Recycled Paper.

If you sell more than five or if you buy even one vehicle for the purpose of reselling it you must have a de aler license. Remember to factor in the cost of auto insurance fuel and repairs too. TeleFile Worksheet and Payment Voucher.

What is the sales tax rate. There are also county taxes of up to 05 and a stadium tax of up to 01. State of Wisconsin.

Calculate By Tax Rate or calculate by zip code. Enter zip code of the sale location or the sales tax rate in percent Sales Tax. Contact the DMV Dealer Agent Section at 608 266-1425 or.

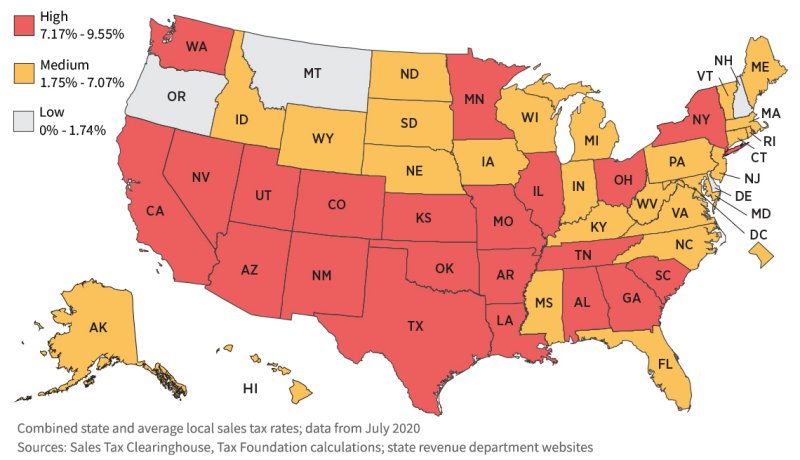

This means that depending on your location within Wisconsin the total tax you pay can be significantly higher than the 5 state sales tax. Municipal governments in Wisconsin are also allowed to collect a local-option sales tax that ranges from 0 to 175 across the state with an average local tax of 0481 for a total of 5481 when combined with the state sales tax. 635 for vehicle 50k or less.

The Wisconsin Department of Transportation WisDOT collects wheel tax fees for the municipality or county keeps an administrative fee of 17 cents per vehicle application and sends the rest to the municipality or county. Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate. Get a dealer license to sell more than five vehicles a year.

The Wisconsin state sales tax rate is 5 and the average WI sales tax after local surtaxes is 543. Department of Revenue Sales and Use Tax. Form ST-12 - Sales and Use Tax Return.

You may use this lookup to determine the Wisconsin state county and baseball stadium district sales tax rates that apply to a location in Wisconsin. 776 rows Wisconsin Sales Tax5. WisDOT collects sales tax due on a vehicle purchase on behalf of DOR.

Some counties also charge a stadium tax of 01 percent notes the Wisconsin Department of Revenue. Wisconsins sales tax on cars for example is 5 percent according to the State Department of Revenue. Calculate By ZIP Code or manually enter.

Wisconsin has a statewide sales tax rate of 5 which has been in place since 1961. Average Sales Tax With Local. This lookup does not identify any other taxes that may also apply such as the local exposition district taxes premier resort area tax rental vehicle fee etc.

Thats lower than the national average but you must also pay registration fees wheel tax local sales tax and more.

Time To Source Smarter Wifi Extender Wifi Booster Signal Booster

Wisconsin Sales Tax Rates By City County 2022

Car Sales Tax In Wisconsin Getjerry Com

Wisconsin Sales Tax Guide And Calculator 2022 Taxjar

Car Sales Tax In Wisconsin Getjerry Com

Unprecedented Wisconsin Tax Revenues Continue To Exceed Expectations Wisconsin Public Radio

Car Donations Program Donate Car Car Donate

Wisconsin Car Registration Everything You Need To Know

Direct Mail Christmas Card 2004 By Kevin Duvalle Via Behance This Is A Clever Holiday Greeting Howeve Clever Business Cards Direct Mail Graphic Design Posters

Should You Be Charging Sales Tax On Your Online Store Backoffice

States With Highest And Lowest Sales Tax Rates

Wisconsin Sales Tax Small Business Guide Truic

How Much Are Tax Title And License Fees In Wisconsin

Wisconsin Sales Use Tax Guide Avalara

How Much Are Tax Title And License Fees In Wisconsin

State Income Tax Rates Highest Lowest 2021 Changes

Capital Gains Tax Explained Propertyinvestment Flip Investing Knowthenumbers Capital Gains Tax Capital Gain Money Isn T Everything